2023 Logistics IT Perspectives

In our annual logistics IT market research report, Inbound Logistics looks at the imperatives that drive shippers to embrace new technology solutions.

In many ways, the spring of 2023 presents an easier supply chain landscape than we saw one year ago. Transportation rates have dropped, the capacity crunch has eased, and container ships no longer sit in dense crowds outside ocean ports.

But we’re still not in the clear. An inflationary economy and tight labor market still make it hard to manage costs. The driver shortage persists. Geopolitical conflicts and natural disasters aggravate supply chain risk.

That’s why companies continue to embrace information technology solutions for the supply chain. These tools help shippers deliver better service to their customers while enhancing the bottom line. They automate routine tasks to increase productivity, analyze vast volumes of data to support better decisions, help match inventory to customer demand, assist in designing more productive logistics networks, and a great deal more.

Each year, Inbound Logistics surveys a variety of logistics technology providers on the state of the market. Our goal is to help logistics professionals understand the possibilities as they investigate new technology.

When you’re done reading the report on the 2023 survey, take a look at this year’s Inbound Logistics Top 100 Logistics IT Providers (see page 62). As you explore future technology investments, this guide will help you zero in on the solutions that best meet your needs.

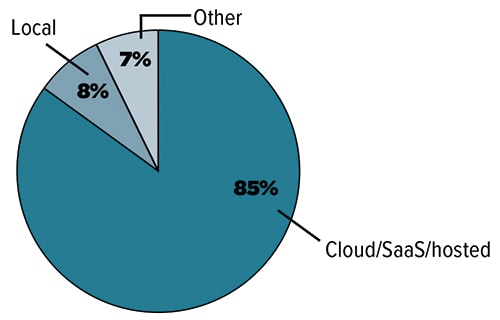

PLATFORM: How do you deliver your solutions?

Over the past several years, the cloud has become the platform of choice for a large majority of logistics IT solutions. In 2019, 55% of respondents said they used a Software-as-a-Service model, and 42% said they offered both cloud-based and locally hosted platforms. In 2023, 85% of vendors deliver their software exclusively in the cloud. A mere 8% offer software that users host on premise. Another 7% offer other kinds of solutions, mainly hybrid approaches that combine cloud-based and locally based functions.

Over the past several years, the cloud has become the platform of choice for a large majority of logistics IT solutions. In 2019, 55% of respondents said they used a Software-as-a-Service model, and 42% said they offered both cloud-based and locally hosted platforms. In 2023, 85% of vendors deliver their software exclusively in the cloud. A mere 8% offer software that users host on premise. Another 7% offer other kinds of solutions, mainly hybrid approaches that combine cloud-based and locally based functions.

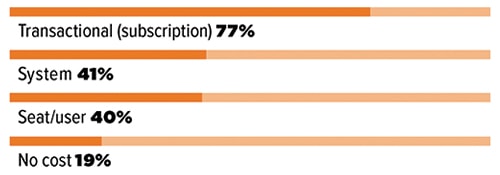

COST BASIS: How do users pay for technology solutions?

When a company implements logistics technology, there may be several payment options. With so many solutions hosted in the cloud, the pay-by-subscription model is a popular choice. In 2023, 77% of survey respondents offer subscriptions. If you’d rather buy a system for a flat rate, 41% of respondents can oblige. A similar number, 40%, can charge by the seat or user. Also, 19% of logistics IT vendors offer solutions free of charge, often as part of a package with other services.

When a company implements logistics technology, there may be several payment options. With so many solutions hosted in the cloud, the pay-by-subscription model is a popular choice. In 2023, 77% of survey respondents offer subscriptions. If you’d rather buy a system for a flat rate, 41% of respondents can oblige. A similar number, 40%, can charge by the seat or user. Also, 19% of logistics IT vendors offer solutions free of charge, often as part of a package with other services.

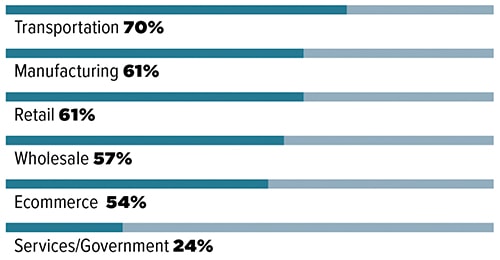

INDUSTRY: What industries do your solutions serve?

In the past, when we asked which industries vendors served, a handful of industries dominated the responses. In 2022, for instance, 91% of vendors said they served the transportation industry—a similar proportion to the number who served that industry pre-pandemic, in 2019.

In the past, when we asked which industries vendors served, a handful of industries dominated the responses. In 2022, for instance, 91% of vendors said they served the transportation industry—a similar proportion to the number who served that industry pre-pandemic, in 2019.

But in 2023, only 70% of vendors say they serve customers in transportation. Other dominant industries have seen similar drops in the past year: manufacturing from 88% in 2022 to 61% in 2023; retail from 80% to 61%; wholesale from 84% to 57%; and ecommerce from 81% to 54%. In this tough economic environment, logistics IT vendors are spreading themselves thinner. They might be seeking further afield for new business, courting customers not just in their traditional market sectors, but also in fields that we currently don’t ask about in the survey.

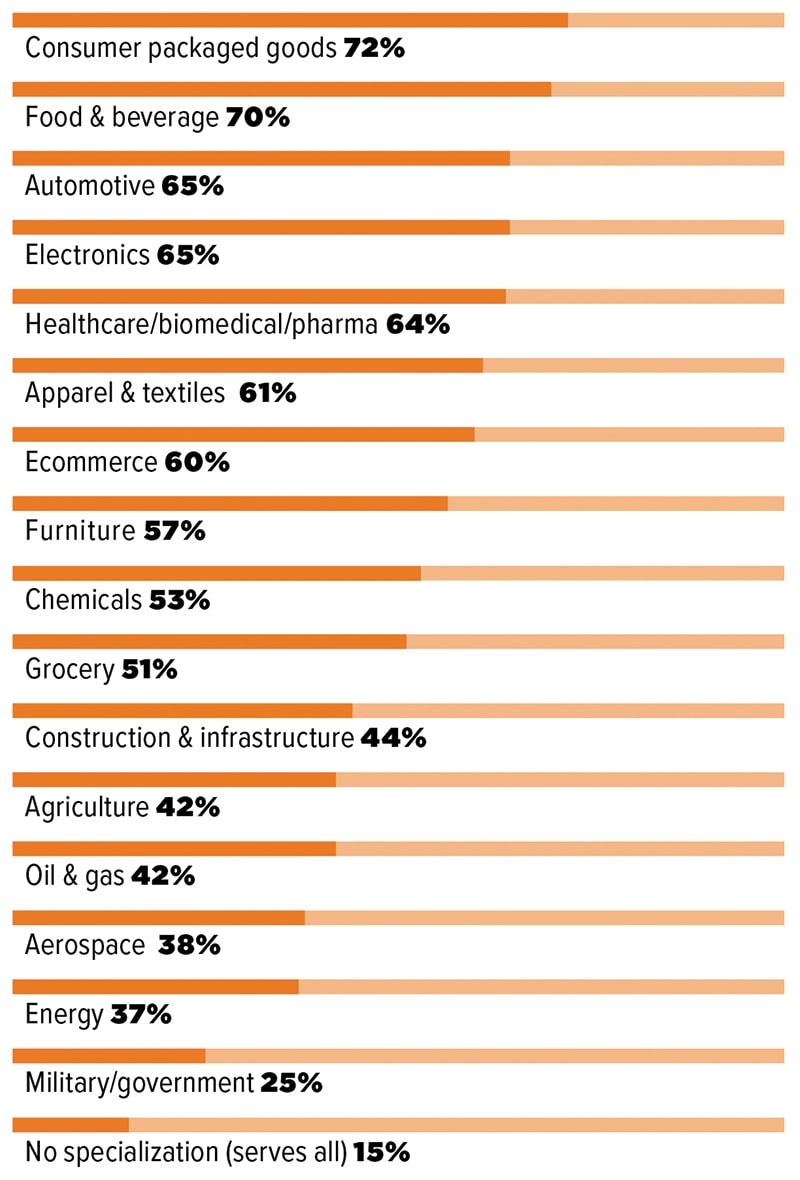

VERTICAL SPECIALIZATION: What verticals do your solutions serve?

When logistics IT vendors target specific vertical markets, the most popular are consumer packaged goods—cited by 72% of respondents—and food and beverage—cited by 70%. Close behind are automotive and electronics (65% each) and healthcare/ biomedical/ pharmaceuticals (64%).

When logistics IT vendors target specific vertical markets, the most popular are consumer packaged goods—cited by 72% of respondents—and food and beverage—cited by 70%. Close behind are automotive and electronics (65% each) and healthcare/ biomedical/ pharmaceuticals (64%).

That number for the healthcare/biomedical/pharma sector has risen by several points since 2021, when it was 59%. Did the experience of the pandemic—with the rush to distribute everything from masks and gloves to newly developed vaccines—prompt more technology vendors to focus on this sector?

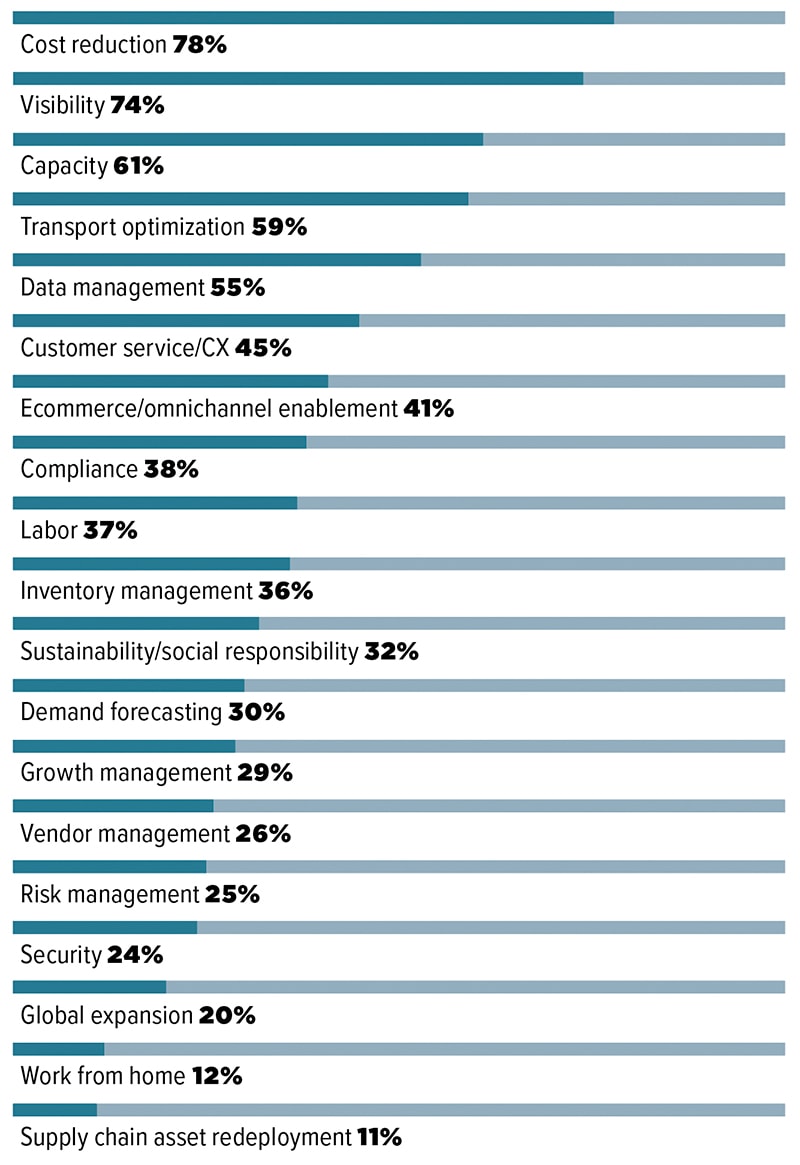

CHALLENGES: Which transportation/logistics challenges are most critical to your customers?

Although cost is always a major concern, as freight rates have leveled off, shippers have spent a bit less time worrying about what they spend. In 2023, 78% of logistics IT vendors told us that cost reduction is a critical challenge for their customers. While that still puts cost at the top of the list, it’s a smaller percentage than in 2022, when 94% of respondents cited cost as a major concern.

Although cost is always a major concern, as freight rates have leveled off, shippers have spent a bit less time worrying about what they spend. In 2023, 78% of logistics IT vendors told us that cost reduction is a critical challenge for their customers. While that still puts cost at the top of the list, it’s a smaller percentage than in 2022, when 94% of respondents cited cost as a major concern.

Even as far back as 2019, 85% of vendors said that the need to cut costs was keeping customers awake at night. So at least some shippers are feeling relief in that department.

Visibility remains the second-biggest concern for companies that use logistics IT: 74% of vendors mention that as a critical challenge. Sixty-one percent of respondents mention capacity, but that’s a significant drop from 2022, when 81% of IT vendors named that as a major concern.

In addition, fewer customers are worried about enabling employees to work from home. Just 12% of IT vendors note that as a concern in 2023, vs. 21% in 2022, when the world was still figuring out how the post-pandemic workplace would look.

Another striking change in recent years concerns sustainability. In 2019, just 17% of IT vendors said this was a critical concern for their customers. In 2023, that number has risen to 32%.

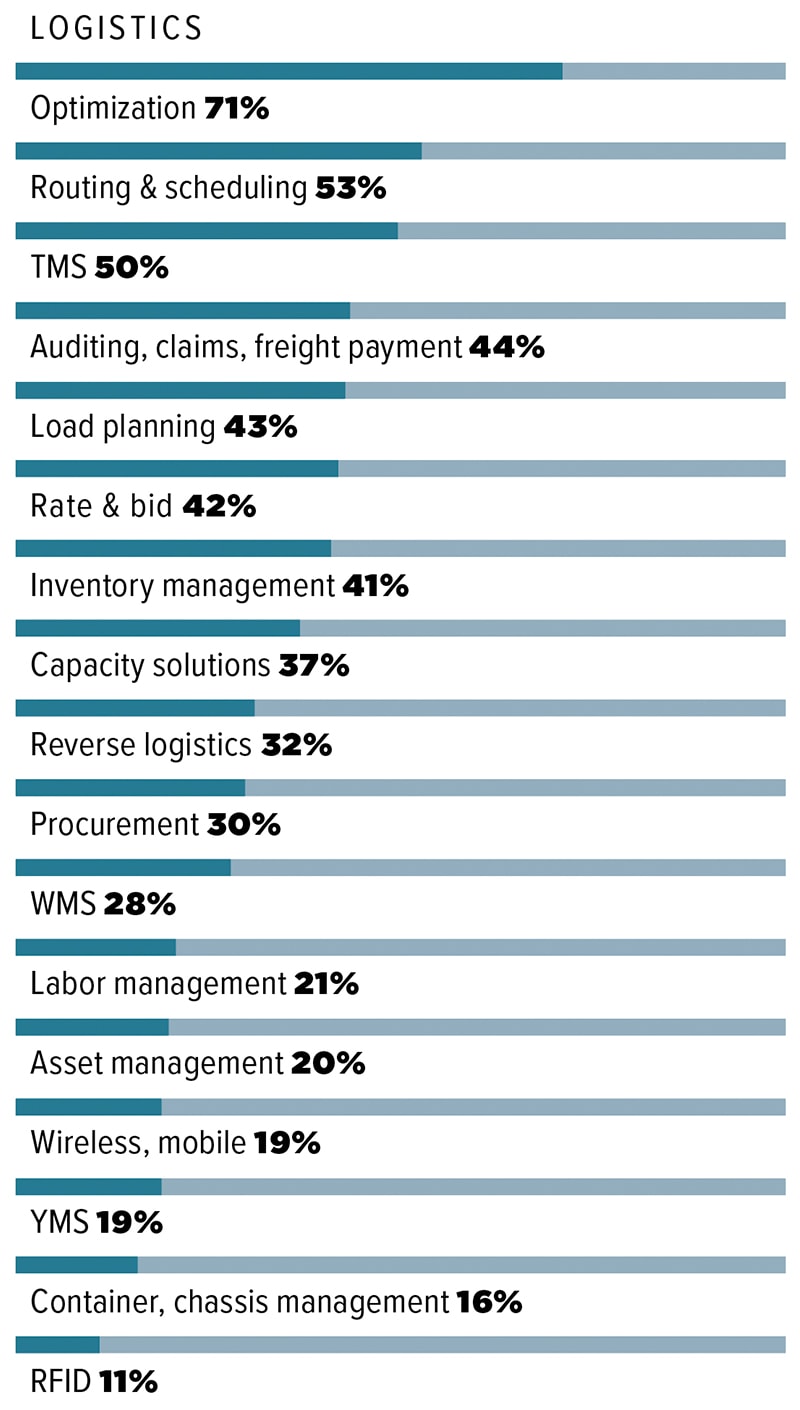

SOLUTIONS OFFERED

Facing both a tight labor market and higher costs, companies these days seek every opportunity to operate more efficiently. That makes process improvement a top priority. Fifty-four percent of survey respondents offer solutions to meet that need.

Facing both a tight labor market and higher costs, companies these days seek every opportunity to operate more efficiently. That makes process improvement a top priority. Fifty-four percent of survey respondents offer solutions to meet that need.

Many vendors also provide solutions for order management (48%), electronic data interchange (47%), supply chain control tower operations (39%), modeling, forecasting, and predictive analytics (38%), and supplier or vendor management (36%).

For the same reasons companies turn to technology to gain overall efficiencies, they also seek solutions to fine-tune their logistics operations. That makes logistics optimization a perennial leader among solutions offered by companies in our survey. Pre-pandemic, in 2019, 72% of respondents said they offered optimization solutions. This year, the number was nearly the same, 71%.

For the same reasons companies turn to technology to gain overall efficiencies, they also seek solutions to fine-tune their logistics operations. That makes logistics optimization a perennial leader among solutions offered by companies in our survey. Pre-pandemic, in 2019, 72% of respondents said they offered optimization solutions. This year, the number was nearly the same, 71%.

Some other popular solutions have fallen slightly in numbers across the pandemic era, although they remain at the top of the list. For example, in 2019, 60% of respondents said they offered solutions for routing and scheduling, while in 2023 that number is 53%. Similarly, 61% of vendors offered transportation management systems (TMS) in 2019, while in 2023 just half of vendors offer such systems. One category—warehouse management systems (WMS)—has seen a slight uptick since before the advent of COVID-19 (23% in 2019 vs. 28% in 2023).

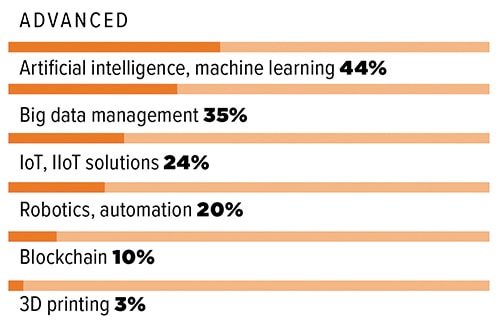

Driverless trucks and delivery drones have yet to transform our industry. But certain advanced technologies are helping companies gain greater insight into their operations, produce better decisions, make dynamic adjustments to their networks, and increase productivity.

Driverless trucks and delivery drones have yet to transform our industry. But certain advanced technologies are helping companies gain greater insight into their operations, produce better decisions, make dynamic adjustments to their networks, and increase productivity.

Among the advanced solutions offered by logistics IT vendors, those based on AI and/or machine learning lead the list. Forty-four percent of respondents say they offer that technology. Big data management is also popular: 35% of vendors incorporate that in their solutions. Less prevalent, but still significant, are the internet of things (IoT) and industrial internet of things (IIoT), cited by 24% of vendors, and robotics or other kinds of advanced automation, cited by 20%.

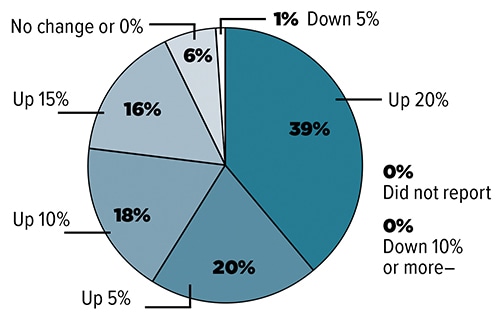

CUSTOMER BASE: During your last measurement period, did your customer base grow? By how much?

Demand for logistics IT solutions continues to be strong. In 2023, 93% of vendors in our survey saw their customer bases grow, the same percentage as in 2022. This is part of an ongoing trend: In 2020, 95% of respondents said they had added more customers in the most recent measurement period. And these are healthy increases.

Demand for logistics IT solutions continues to be strong. In 2023, 93% of vendors in our survey saw their customer bases grow, the same percentage as in 2022. This is part of an ongoing trend: In 2020, 95% of respondents said they had added more customers in the most recent measurement period. And these are healthy increases.

In 2023, more than half of vendors report that their customer bases have grown by 15% or more. The numbers have stayed flat for just 6% of vendors, and a mere 1% have lost customers. Clearly, new and better offerings are driving more shippers to embrace logistics IT solutions to help them overcome the challenges of a difficult economy.

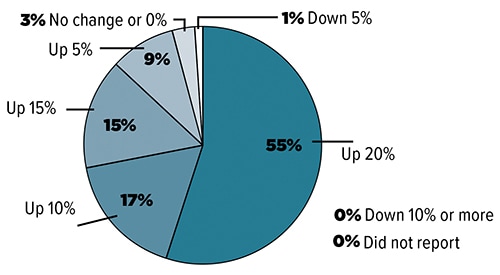

SALES: During your last measurement period, were sales up or down? by how much?

Not only are shippers embracing logistics IT, but they’ve been making significant investments in those solutions. In 2023, as in 2022, 96% of survey respondents report increased sales in the most recent measurement period. In 2023, 55% have seen sales increase by 20%. Another 32% have seen growth of 10% or more. Only 3% report no change, and just 1% saw revenues drop—and that by only 5%.

Not only are shippers embracing logistics IT, but they’ve been making significant investments in those solutions. In 2023, as in 2022, 96% of survey respondents report increased sales in the most recent measurement period. In 2023, 55% have seen sales increase by 20%. Another 32% have seen growth of 10% or more. Only 3% report no change, and just 1% saw revenues drop—and that by only 5%.

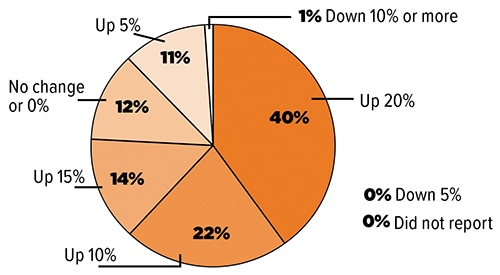

PROFITS: During your last measurement period, were profits up or down? By how much?

Logistics IT is a profitable market as well as a growing one. In 2023, 87% of vendors who responded to our survey report that profits increased in the last measurement period. For 76% of vendors, growth was strong, with profits up 10% or more. This continues the trend of 2022, when 86% of vendors reported that profits were up, and 75% saw an increase of 10% or more. Some vendors—12%—saw no change in profits. Only 1% netted less in the most recent measurement period than in the previous one.

Logistics IT is a profitable market as well as a growing one. In 2023, 87% of vendors who responded to our survey report that profits increased in the last measurement period. For 76% of vendors, growth was strong, with profits up 10% or more. This continues the trend of 2022, when 86% of vendors reported that profits were up, and 75% saw an increase of 10% or more. Some vendors—12%—saw no change in profits. Only 1% netted less in the most recent measurement period than in the previous one.

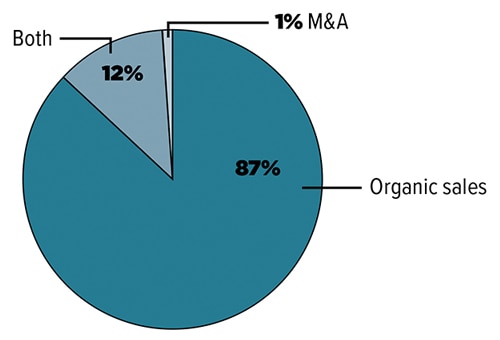

GROWTH: What led to growth in the past year?

Mergers and acquisitions might have been all the rage in recent years, but among suppliers of logistics IT that trend is slowing. Only 1% of respondents attributed their growth over the past year to M&A. Twelve percent of vendors say their growth came from a mix of organic sales and M&A, compared with 18% in 2022. In contrast, 87% say their growth came thanks entirely to organic sales, an increase over the 81% who cited direct sales in 2022.

Mergers and acquisitions might have been all the rage in recent years, but among suppliers of logistics IT that trend is slowing. Only 1% of respondents attributed their growth over the past year to M&A. Twelve percent of vendors say their growth came from a mix of organic sales and M&A, compared with 18% in 2022. In contrast, 87% say their growth came thanks entirely to organic sales, an increase over the 81% who cited direct sales in 2022.

WHERE IS THE MOST DEMAND?

Where do vendors see the greatest increase in demand for logistics IT solutions? Here’s a sampling of responses from the vendors responding to our survey:

- We observe the greatest demand for yard management systems in North America and Europe, for transportation management systems mainly in North America, for terminal operating systems in the Americas, EMEA, and APAC, for container maintenance & repair in the Americas, EMEA, and APAC, and for intermodal container depots in the Americas, EMEA, and APAC.

- We continue to see focus on middle-mile/final-mile logistics across verticals and transportation modes. Visibility into the supply chain and event-driven alerting to minimize disruption and improve service and efficiency are top priorities for shippers and logistics service providers.

- Global supply chains have become more difficult to manage. Things have become highly volatile, with last-minute cargo changes causing headaches for transportation specialists and challenges arising from unexpected changes in consumer buying patterns and expectations.

- We observe several reasons for growing demand for new technology, including below-average productivity, labor shortages, high turnover, and an inability to meet service level agreements across all vertical markets.

- We have had multiple customers go from only wanting to know that tracking is on their shipment, to being able to observe the tracking in real time, to having their own platform created by us so that they can see every detail going on with each shipment.

- We’re seeing a lot of demand for logistics technology for asset management, inventory management, and overall digital transformation strategy.

WHAT’S HARD ABOUT LOGISTICS TODAY?

Cost is a perennial challenge for shippers. With transportation rates easing, the challenge for shippers now is how to capture those savings to offset expenses in other areas. “Where costs were inflated over the past two years, they now want to use technology and automation to identify and get those cost reductions,” says Britain Pavlic, director of transportation technology at enVista Corp., which is based in Carmel, Indiana.

The tight labor market, with its pressure to increase wages, also poses a challenge. “The need to balance labor and automation is also something that we’re seeing quite a bit of,” says Tom Stretar, enVista’s vice president, technology. enVista’s automation and labor management teams work in sync to help companies determine how to get the best return on investments in automation and in labor management solutions.

Darrell Ortiz, founder and CEO of CDM Software Solutions in Houston, says many of his customers face a special customer service challenge. “The freight forwarders and NVOs (non-vessel operating common carriers) are looking to expand their tracking capability to the first mile and last mile,” he says. To meet this need, CDM offers a simple app that intermediaries can give to drayage carriers, letting even very small truckers communicate digitally about pickups and deliveries.

As shippers strive to please their customers while managing costs, capacity, and labor, one big obstacle they face is the volume of data they can mine for business intelligence. “They’re drowning in data,” says Ram Krishnan, global head, customer success, at Aera Technology. Any large company that makes and ships products has more than 100 applications, which generate as many as 200 operational key performance indicators. “Dashboards built for different levels of management have ballooned across the organization,” he says.

The tools tell managers what has happened in the supply chain, but they don’t explain why it happened or what to do about it, Krishnan says. Aera Technology helps companies analyze what lies behind the data, offering suggestions about how to mitigate problems and seize opportunities.